【印刷可能】 cross check meaning bank 351802-Cross-check or crosscheck

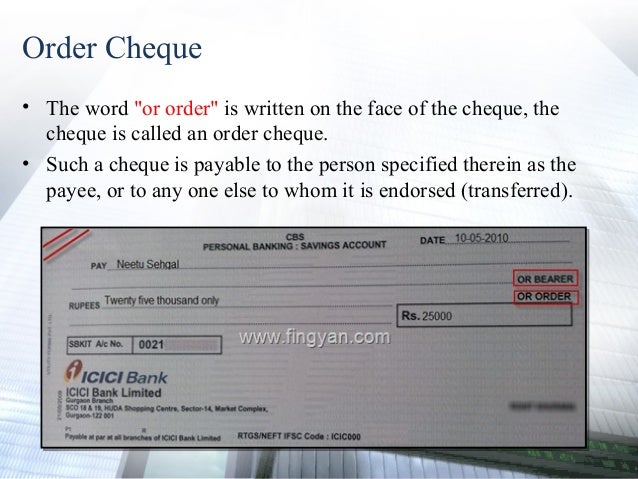

Synonyms for crosscheck include documentation, doublechecking, substantiation, validation, verification, document, doublecheck, substantiate, validate and verifySee spelling differences), is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issuedThe person writing the cheque, known as the drawer, has a transaction banking account (often called a current, cheque, chequing or checking account) where theirSimilar words crisscross, cashier's check, swiss cheese, check, check out, check off, check in, recheck Meaning n 1 an instance of confirming something by considering information from several sources 2 an illegal check (chopping at an opponent's arms or stick)

What Are The Parts Or Elements Of A Cheque Current Account Lawyerment Knowledge Base

Cross-check or crosscheck

Cross-check or crosscheck-Cross To match, by a single broker or dealer, a buy order and a sell order For example, a floor broker may have an order to buy 500 shares of IBM at $1 and another order to sell 500 shares of IBM at the same price Subject to certain rules, the floor broker may cross the order by matching the sell and the buy ordersThe act of crosschecking a means of crosschecking I examined contemporary newspaper reports as a crosscheck on his account Ice Hockey an obstructing or impeding of the movement or

Cheque

Mar 08, 18 · Identity theft and forgery are serious issues in the banking industry In an effort to prevent such criminal activities, your bank likely will return an illegible check, a check filled out incorrectly or one that appears altered Although the best practice guideline for correcting a mistake on a check is to void it and start over with a new one, some banks will process altered checksCross River Bank combines the trust and reliability of a community bank with the cutting edge innovation of a technology company to offer small businesses the banking and technology services they need in the timely fashion they need it During the initial round of the PPP, Cross River Bank was one of the leading lenders in the countryDefinition and synonyms of crosscheck from the online English dictionary from Macmillan Education This is the British English definition of crosscheckView American English definition of crosscheck Change your default dictionary to American English

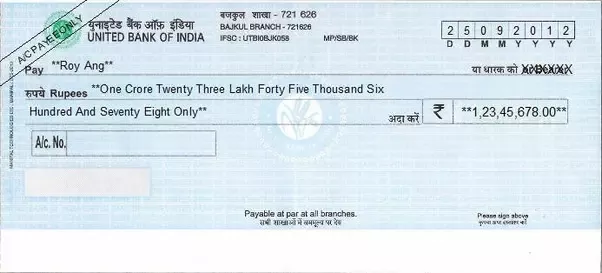

/ ˈ / to make certain that information, a calculation, etc, is correct, by asking a different person or using a different method of calculation We used to crosscheck the information in the reportsNov 26, · To write an account payee cheque, you must cross two lines on the left corner of the cheque and write "Account Payee" between the two lines Remember, if you simply cross the cheque and do not write the words "Account Payee", itSep , 18 · Crossmatching is a test used to check for harmful interactions between your blood and specific donor blood or organs It can help your doctor predict how your body will

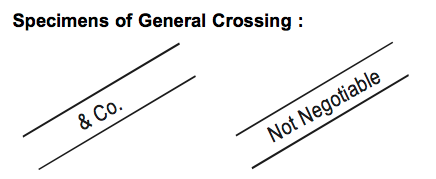

There is no overseas crossborder cheque clearing system A foreign cheque is a cheque issued in a foreign currency and payable at a foreign bank Therefore, for payment purposes, foreign cheques payable to recipients in this country have to be sent abroad to the bank where the payer holds their accountJun , · A bank draft is a check that is drawn on a bank's funds and guaranteed by the bank that issues it Similar to a cashier's check, a legitimate bank draft is safer than a personal check when accepting large payments To get a banker's draft, a bank customer must have funds (or cash) availableNov 17, 18 · A crossed check is one that includes two parallel lines through the topleft corner or across the entire check Crossed checks are more secure than regular checks, because the "cross" indicates that a bank can't cash the check immediately

Bearer Cheque Bearer Cheque Meaning What Is Bearer Cheque

What Is Cheque Write A Cheque Types Of Cheques

Apr 24, 14 · A cross check is defined as follows The action of using the shaft of the stick between the two hands to forcefully check an opponent Imagine making two fists and holding something between themStriking two parallel lines on the top left corner of the cheque is called Crossing of Cheques This symbol simply means that cheques can only be deposited directly into a bank account and can't be immediately encashed over the counter in any branch of a bankCrosscheck meaning 1 to make certain that information, a calculation, etc is correct, by asking a different person Learn more

File Sample Cheque Jpeg Wikimedia Commons

How Do You Write A Cheque Uk

A cheque, or check (American English;Apart from these three, there are two more parties to aCrosscheck definition is to obstruct in ice hockey or lacrosse by thrusting one's stick held in both hands across an opponent's face or body

What Are The Parts Or Elements Of A Cheque Current Account Lawyerment Knowledge Base

How To Fill Up A Cheque Quora

$50 minimum opening deposit FREE Cross Keys Bank wallet checks (first box) Higher interest rate with balance of $1,500 or more Competitive interest if balance falls below $1,500 Only $10 monthly chargeWebsite Phone number Mailing address crosscheckcom (800) CrossCheck, Inc Attn Consumer Inquiry Department PO Box 6008 Petaluma, CAParties to Cheque Basically, there are three parties to a cheque Drawer The person who draws the cheque, ie signs and orders the bank to pay the sum;

John Makes Out A Cheque In Favour Of Thabo And Crosses And Marks It Not Negotiable This Is A General Crossing But The Words Not Negotiable Have Ppt Download

Crossing Of The Cheques Law Times Journal

What You'll See While checks can vary depending on who issues or prints them, the back of a check generally has three separate sections Endorsement area This is where you endorse, or sign, the check when you're ready to deposit or cash it This might be as simple as adding your signature, but it's safest to use an endorsement that restricts how the check can be usedPayee The beneficiary, ie to whom the amount is to be paid;Apr 03, · A manager's check is a secure check that a bank issues for an individual who has purchased it They are also called treasurer's checks, official checks and certified checks All parties involved in a transaction benefit from the use of a manager's check There are several advantages for paying by manager's check

Crossing Of Cheque Meaning Of Cross Cheque Types Of Crossing

What Is The Difference Between A Bearer Cheque And A Crossed Cheque Quora

コメント

コメントを投稿